Unveiling the Enigma of ERM and QRM in Life Insurance: A Comprehensive Guide

The life insurance industry is a complex and dynamic landscape, characterized by evolving risks and regulatory requirements. To navigate this challenging environment, insurers are increasingly adopting sophisticated risk management frameworks, including Enterprise Risk Management (ERM) and Quantitative Risk Management (QRM). These frameworks provide a systematic approach to identifying, assessing, and mitigating risks, enabling insurers to make informed decisions and enhance their overall resilience.

5 out of 5

| Language | : | English |

| File size | : | 7980 KB |

| Print length | : | 244 pages |

Enterprise Risk Management (ERM)

ERM is a comprehensive risk management approach that encompasses all aspects of an organization's operations. It involves identifying and assessing risks across the entire enterprise, including financial, operational, strategic, and reputational risks. ERM aims to provide a holistic view of risk exposure, enabling organizations to make informed decisions and allocate resources effectively.

In the context of life insurance, ERM plays a crucial role in ensuring the long-term sustainability and solvency of insurers. It helps insurers to:

- Identify and manage a wide range of risks, including underwriting risks, investment risks, and operational risks.

- Develop a comprehensive risk management strategy that aligns with the organization's objectives and risk appetite.

- Implement risk mitigation measures to reduce the likelihood and impact of potential risks.

- Monitor risks and adjust risk management strategies as needed to respond to changing circumstances.

Quantitative Risk Management (QRM)

QRM is a specialized field of risk management that uses mathematical and statistical techniques to quantify and manage risks. It involves developing and applying mathematical models to assess the probability and financial impact of potential risks. QRM enables insurers to make more informed decisions about risk-taking and capital allocation.

In the context of life insurance, QRM is used in a variety of applications, including:

- Pricing and underwriting: QRM techniques are used to calculate premiums and assess the risk of individual policyholders.

- Investment risk management: QRM models are used to assess the risk and return of investment portfolios.

- Solvency and capital management: QRM tools are used to calculate the amount of capital required to meet regulatory solvency requirements.

- Stress testing: QRM models are used to simulate extreme market conditions and assess the potential impact on the insurer's financial position.

Challenges and Opportunities of ERM and QRM in Life Insurance

While ERM and QRM offer significant benefits to life insurers, there are also challenges associated with their implementation and use. These challenges include:

- Data availability and quality: ERM and QRM require access to accurate and timely data to effectively assess and manage risks.

- Model complexity: QRM models can be complex and require specialized expertise to develop and interpret.

- Regulatory requirements: Insurers are subject to a variety of regulatory requirements related to ERM and QRM, which can add to the complexity of implementation.

Despite these challenges, ERM and QRM offer significant opportunities for life insurers to improve their risk management practices and enhance their overall resilience. These opportunities include:

- Improved risk visibility: ERM provides a comprehensive view of risk exposure, enabling insurers to make informed decisions and allocate resources effectively.

- Enhanced risk mitigation: QRM techniques enable insurers to quantify and manage risks more precisely, allowing them to develop more effective risk mitigation strategies.

- Improved capital management: ERM and QRM tools help insurers to optimize capital allocation, ensuring that they have sufficient capital to meet regulatory requirements and absorb potential losses.

- Increased competitiveness: Insurers that effectively implement ERM and QRM can gain a competitive advantage by demonstrating their commitment to risk management and financial stability.

ERM and QRM are essential tools for life insurers to manage the complex and evolving risks they face. By adopting these frameworks, insurers can gain a comprehensive understanding of their risk exposure, make informed decisions about risk-taking, and allocate resources effectively. ERM and QRM can help insurers to enhance their resilience, improve their financial performance, and better serve their customers.

As the life insurance industry continues to evolve, ERM and QRM will become increasingly important for insurers to navigate the challenges and opportunities of the future. Insurers that embrace these frameworks will be better positioned to succeed in the dynamic and competitive market environment.

5 out of 5

| Language | : | English |

| File size | : | 7980 KB |

| Print length | : | 244 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Linda Fisher Thornton

Linda Fisher Thornton Eric Helleiner

Eric Helleiner Lance Akiyama

Lance Akiyama Michelle Madow

Michelle Madow Ernesto Galarza

Ernesto Galarza Melissa Ackerman

Melissa Ackerman Lisa Campell

Lisa Campell Eric Knowles

Eric Knowles Joshua Lyon

Joshua Lyon G E R Lloyd

G E R Lloyd Peter R Mansoor

Peter R Mansoor Mildred Council

Mildred Council Eric Thomson

Eric Thomson Nobody You Ve Heard Of

Nobody You Ve Heard Of Roderick A Munro

Roderick A Munro Karim M Abadir

Karim M Abadir Shonda Schilling

Shonda Schilling Jeremy Keeshin

Jeremy Keeshin Martha Bergland

Martha Bergland Rebecca Rather

Rebecca Rather

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Forrest Blair12-Step Guide to Master Life and Achieve Your Goals: A Comprehensive Guide to...

Forrest Blair12-Step Guide to Master Life and Achieve Your Goals: A Comprehensive Guide to...

Rex HayesThe Most Absolute and Up-to-Date Test Prep for the Commercial Driver License:...

Rex HayesThe Most Absolute and Up-to-Date Test Prep for the Commercial Driver License:...

Felix CarterUnlock the Secrets of Mental Math: Master Numerical Calculations Effortlessly

Felix CarterUnlock the Secrets of Mental Math: Master Numerical Calculations Effortlessly Denzel HayesFollow ·7.5k

Denzel HayesFollow ·7.5k Dillon HayesFollow ·18.6k

Dillon HayesFollow ·18.6k Neal WardFollow ·7.8k

Neal WardFollow ·7.8k Paulo CoelhoFollow ·3.4k

Paulo CoelhoFollow ·3.4k Jason HayesFollow ·14.4k

Jason HayesFollow ·14.4k Randy HayesFollow ·11.3k

Randy HayesFollow ·11.3k Julian PowellFollow ·18.4k

Julian PowellFollow ·18.4k Clay PowellFollow ·7.1k

Clay PowellFollow ·7.1k

Roland Hayes

Roland HayesMagda: A Mother's Love, A Daughter's Redemption - A...

Immerse Yourself in the Captivating True Story...

Spencer Powell

Spencer PowellSnow White Retold: A Tale of Love, Magic, and...

Once upon a time, in...

Jake Powell

Jake PowellMaster the SATs with Effective Strategies from 99th...

The SATs are a challenging exam,...

Brian Bell

Brian BellSEO for Dummies: Unlock the Secrets to Search Engine...

In today's digital...

Jaylen Mitchell

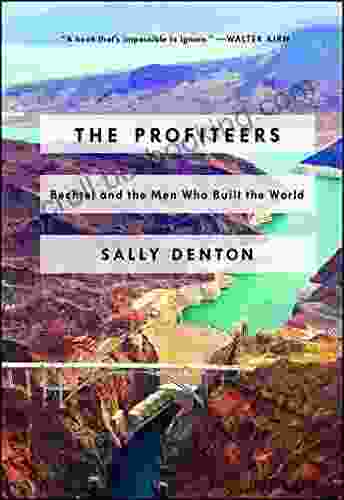

Jaylen MitchellBechtel: Unveiling the Unsung Heroes Who Built the World

In the annals of global infrastructure, the...

5 out of 5

| Language | : | English |

| File size | : | 7980 KB |

| Print length | : | 244 pages |