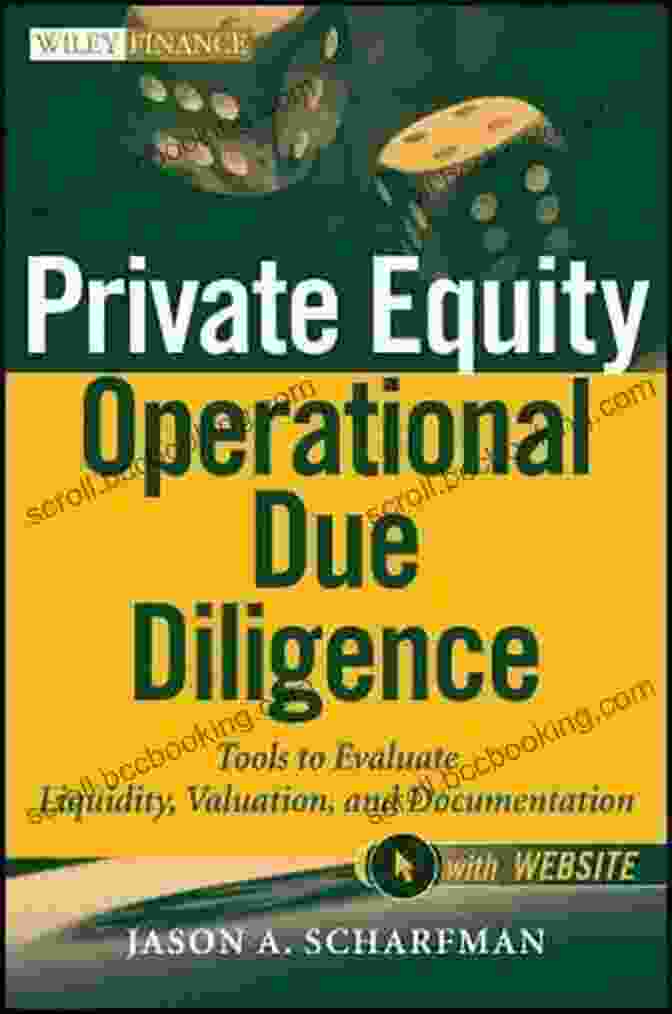

Private Equity Operational Due Diligence: An Insider's Guide to Unlocking Value Creation

Private equity firms are increasingly recognizing the importance of operational due diligence in identifying and mitigating risks and unlocking value creation in their investments. Operational due diligence is a systematic process of evaluating a target company's operations and management team to assess its potential for growth and profitability.

4.3 out of 5

| Language | : | English |

| File size | : | 2866 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 403 pages |

| Lending | : | Enabled |

This book provides a comprehensive framework for conducting operational due diligence in private equity investments. Written by a team of experienced professionals, this book covers every aspect of the process, from planning and execution to analysis and reporting.

Benefits of Operational Due Diligence

Operational due diligence can provide private equity firms with a number of benefits, including:

- Improved risk management: Operational due diligence can help private equity firms identify and mitigate risks associated with their investments.

- Enhanced value creation: Operational due diligence can help private equity firms identify opportunities to improve the operations and profitability of their investments.

- Better investment decisions: Operational due diligence can provide private equity firms with the information they need to make informed investment decisions.

The Operational Due Diligence Process

The operational due diligence process typically involves the following steps:

- Planning: The first step in the operational due diligence process is to develop a plan that outlines the scope of the review, the resources that will be required, and the timeline for completion.

- Data collection: The next step is to collect data from the target company. This data may include financial statements, operational reports, and management presentations.

- Analysis: Once the data has been collected, it is important to analyze it to identify key trends and issues.

- Reporting: The final step in the operational due diligence process is to prepare a report that summarizes the findings of the review.

Best Practices for Operational Due Diligence

There are a number of best practices that private equity firms can follow to improve the effectiveness of their operational due diligence process. These best practices include:

- Involve a cross-functional team: Operational due diligence should be conducted by a cross-functional team with expertise in a variety of areas, such as finance, operations, and human resources.

- Use a structured approach: The operational due diligence process should be structured and systematic to ensure that all key areas are covered.

- Get management buy-in: It is important to get management buy-in for the operational due diligence process. This will help to ensure that the process is successful and that the findings are actionable.

Operational due diligence is a critical part of the private equity investment process. By following the best practices outlined in this book, private equity firms can improve the effectiveness of their operational due diligence process and unlock value creation in their investments.

About the Authors

The authors of this book are a team of experienced professionals with over 20 years of experience in private equity and operational due diligence. They have worked with some of the world's leading private equity firms and have helped them to identify and mitigate risks and unlock value creation in their investments.

Free Download Your Copy Today!

Private Equity Operational Due Diligence: An Insider's Guide to Unlocking Value Creation is available now. Free Download your copy today and start unlocking value creation in your private equity investments.

4.3 out of 5

| Language | : | English |

| File size | : | 2866 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 403 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Shelli Marie

Shelli Marie T M Franklin

T M Franklin Stephanie Cooke

Stephanie Cooke Peter Schiessl

Peter Schiessl Eric Lomax

Eric Lomax Erica Handon

Erica Handon Eric Cervini

Eric Cervini Laurence Bergreen

Laurence Bergreen Eustacia Cutler

Eustacia Cutler Mikki Morrissette

Mikki Morrissette Eric Larson

Eric Larson Erik Loomis

Erik Loomis Erin Beaty

Erin Beaty Stephanie Rosenbloom

Stephanie Rosenbloom Hugh Seaton

Hugh Seaton Sylvester Nemes

Sylvester Nemes Ty Alexander

Ty Alexander Jonathan Franklin

Jonathan Franklin Mako

Mako Olivia Cockett

Olivia Cockett

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Donald WardExploring the Enigma of Mass Movements: A Comprehensive Review of "Thoughts...

Donald WardExploring the Enigma of Mass Movements: A Comprehensive Review of "Thoughts...

Isaac MitchellThe Inspiring Story of an American Champion: A Long Distance Quest to Achieve...

Isaac MitchellThe Inspiring Story of an American Champion: A Long Distance Quest to Achieve... George HayesFollow ·19.2k

George HayesFollow ·19.2k Hamilton BellFollow ·14.4k

Hamilton BellFollow ·14.4k Bryce FosterFollow ·18.9k

Bryce FosterFollow ·18.9k Jacques BellFollow ·18.3k

Jacques BellFollow ·18.3k Carson BlairFollow ·7.5k

Carson BlairFollow ·7.5k Howard PowellFollow ·7k

Howard PowellFollow ·7k Floyd RichardsonFollow ·6.9k

Floyd RichardsonFollow ·6.9k Darrell PowellFollow ·13.7k

Darrell PowellFollow ·13.7k

Roland Hayes

Roland HayesMagda: A Mother's Love, A Daughter's Redemption - A...

Immerse Yourself in the Captivating True Story...

Spencer Powell

Spencer PowellSnow White Retold: A Tale of Love, Magic, and...

Once upon a time, in...

Jake Powell

Jake PowellMaster the SATs with Effective Strategies from 99th...

The SATs are a challenging exam,...

Brian Bell

Brian BellSEO for Dummies: Unlock the Secrets to Search Engine...

In today's digital...

Jaylen Mitchell

Jaylen MitchellBechtel: Unveiling the Unsung Heroes Who Built the World

In the annals of global infrastructure, the...

4.3 out of 5

| Language | : | English |

| File size | : | 2866 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 403 pages |

| Lending | : | Enabled |