What We've Learned and Still Have to Learn from the Financial Crisis: A Comprehensive Analysis

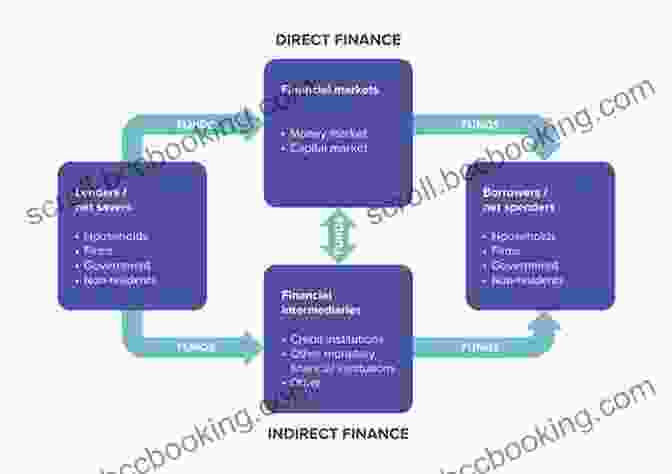

The financial crisis of 2008 was a watershed moment in economic history. It sent shockwaves through the global financial system, leading to a severe economic downturn and widespread job losses. In the years since, there have been extensive efforts to understand the causes of the crisis and to implement measures to prevent a similar catastrophe from happening again.

This article presents a comprehensive analysis of the financial crisis, highlighting the key lessons learned and identifying areas where further progress is needed. By examining the systemic factors that contributed to the crisis, as well as the regulatory failures and risk management practices that exacerbated its impact, we can gain valuable insights for shaping future economic policies and safeguarding the stability of the financial system.

4.2 out of 5

| Language | : | English |

| File size | : | 9272 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 530 pages |

The Key Causes of the Financial Crisis

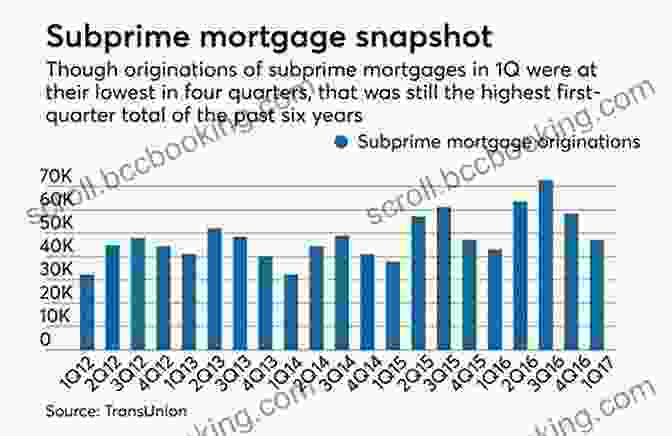

Subprime Lending and the Housing Bubble: One of the primary triggers of the financial crisis was the surge in subprime lending. Subprime mortgages are loans made to borrowers with poor credit histories and low credit scores. As housing prices continued to rise, lenders became more aggressive in extending subprime loans, leading to a significant increase in risky mortgages.

Credit Default Swaps and Systemic Risk: Credit default swaps (CDSs) are financial instruments that allow investors to insure against the risk of default on bonds or loans. In the years leading up to the crisis, there was a dramatic increase in the issuance of CDSs, particularly on subprime mortgages. This created a complex web of interconnectedness within the financial system, amplifying the systemic risk associated with the housing market.

Regulatory Failures and Lack of Oversight: The financial crisis also exposed significant weaknesses in the regulatory framework governing the financial industry. The lack of adequate oversight and regulation allowed excessive risk-taking by banks and other financial institutions. This regulatory failure played a major role in the buildup of systemic risk and contributed to the severity of the crisis.

The Lessons We've Learned

The Importance of Risk Management: The financial crisis highlighted the critical importance of risk management in the financial system. Institutions must have robust risk management frameworks in place to identify, assess, and mitigate potential risks. This includes stress testing, scenario analysis, and maintaining adequate capital buffers.

The Need for Regulatory Reforms: The crisis also demonstrated the need for comprehensive regulatory reforms to strengthen the oversight and regulation of the financial industry. These reforms aim to prevent excessive risk-taking, promote financial stability, and protect consumers. They include measures such as increased capital requirements, stricter liquidity standards, and enhanced supervision.

The Importance of Financial Education: The crisis revealed that many consumers did not have a clear understanding of the financial products they were purchasing, including mortgages and other complex financial instruments. Financial education is essential to empower consumers to make informed financial decisions and protect themselves from predatory lending practices.

What We Still Have to Learn

Despite the progress made since the financial crisis, there are still areas where further learning and improvement are needed:

The Evolution of Financial Markets: The financial industry is constantly evolving, with new products and technologies emerging. It is crucial for regulators and policymakers to stay abreast of these developments and adapt the regulatory framework accordingly to address potential risks.

Macroeconomic Factors and Systemic Risk: The interplay between macroeconomic factors, such as interest rates, inflation, and global economic conditions, and systemic risk is complex and not fully understood. Further research is needed to improve our ability to identify and mitigate systemic risks.

The Role of Technology and Data: Technology is transforming the financial industry, but it also introduces new challenges and risks. Regulators and policymakers must consider how to harness the benefits of technology while mitigating potential negative consequences.

The financial crisis of 2008 was a sobering reminder of the fragility of the global financial system. However, it also provided valuable lessons that have led to important reforms and improvements. By continuing to learn and adapt, we can strengthen the financial system and reduce the likelihood of future crises.

This article has provided a comprehensive overview of the causes, lessons learned, and ongoing challenges related to the financial crisis. It is essential that policymakers, regulators, financial institutions, and consumers alike stay vigilant and continue to work together to ensure a more stable and resilient financial system for the future.

4.2 out of 5

| Language | : | English |

| File size | : | 9272 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 530 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Eric Lodgins

Eric Lodgins Sasha Gong

Sasha Gong Erin Meyer

Erin Meyer Steven M Pillitu

Steven M Pillitu Ernest Renan

Ernest Renan K M Shea

K M Shea Nuno Almeida

Nuno Almeida Steve Turner

Steve Turner Marvin Kalb

Marvin Kalb Jaron Lanier

Jaron Lanier Thomas Coskeran

Thomas Coskeran Eric Worre

Eric Worre Erica Katz

Erica Katz Erica Fischer

Erica Fischer Erik Larson

Erik Larson Kathleen Kirkland

Kathleen Kirkland Patrick Trese

Patrick Trese Forrest Galante

Forrest Galante Susan Rosenberg

Susan Rosenberg Nobody You Ve Heard Of

Nobody You Ve Heard Of

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Steven HayesEmbark on a Journey of Joy: Discover the Hidden Treasures in Everyday Moments

Steven HayesEmbark on a Journey of Joy: Discover the Hidden Treasures in Everyday Moments

Anthony BurgessRadical Approach to the Philosophy of Business: Unveiling the Secrets to...

Anthony BurgessRadical Approach to the Philosophy of Business: Unveiling the Secrets to...

Ibrahim BlairRoyally Good Recipes from the Texas Hill Country: A Culinary Adventure at...

Ibrahim BlairRoyally Good Recipes from the Texas Hill Country: A Culinary Adventure at...

Cody Russell000 Miles By Boot Raft And Ski: An Extraordinary Adventure of Survival and...

Cody Russell000 Miles By Boot Raft And Ski: An Extraordinary Adventure of Survival and... Fernando PessoaFollow ·3.9k

Fernando PessoaFollow ·3.9k Jayson PowellFollow ·19.8k

Jayson PowellFollow ·19.8k Floyd RichardsonFollow ·6.9k

Floyd RichardsonFollow ·6.9k Nathaniel HawthorneFollow ·13.5k

Nathaniel HawthorneFollow ·13.5k T.S. EliotFollow ·3k

T.S. EliotFollow ·3k Chinua AchebeFollow ·5.1k

Chinua AchebeFollow ·5.1k Ethan MitchellFollow ·11k

Ethan MitchellFollow ·11k Jeremy CookFollow ·13.2k

Jeremy CookFollow ·13.2k

Roland Hayes

Roland HayesMagda: A Mother's Love, A Daughter's Redemption - A...

Immerse Yourself in the Captivating True Story...

Spencer Powell

Spencer PowellSnow White Retold: A Tale of Love, Magic, and...

Once upon a time, in...

Jake Powell

Jake PowellMaster the SATs with Effective Strategies from 99th...

The SATs are a challenging exam,...

Brian Bell

Brian BellSEO for Dummies: Unlock the Secrets to Search Engine...

In today's digital...

Jaylen Mitchell

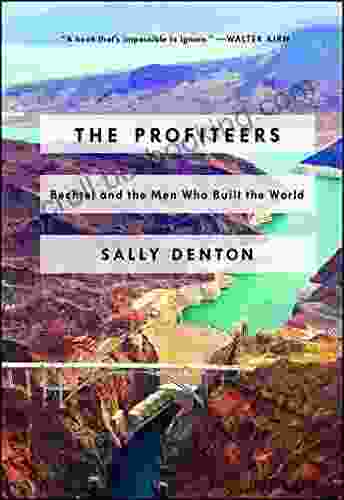

Jaylen MitchellBechtel: Unveiling the Unsung Heroes Who Built the World

In the annals of global infrastructure, the...

4.2 out of 5

| Language | : | English |

| File size | : | 9272 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 530 pages |