Understanding Interest Rate Swaps by Murray Rothbard: A Comprehensive Guide

In the labyrinthine world of financial markets, where complex instruments shape the ebb and flow of global capital, one stands out as a pivotal force: the interest rate swap.

4.1 out of 5

| Language | : | English |

| File size | : | 5131 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Word Wise | : | Enabled |

| Print length | : | 320 pages |

Interest rate swaps, intricate financial agreements that facilitate the exchange of future cash flows, have emerged as essential tools for managing risk and optimizing investment strategies. In his seminal work, "Understanding Interest Rate Swaps," renowned economist and libertarian philosopher Murray Rothbard delves into the complexities of these financial instruments, unraveling their multifaceted nature and profound impact on the global economy.

The Essence of Interest Rate Swaps

Imagine a scenario where a homeowner with a fixed-rate mortgage faces the prospect of rising interest rates. Concerned about the impending financial burden, they may seek to hedge their exposure. An interest rate swap offers a solution.

Through an interest rate swap, the homeowner can exchange their fixed-rate payments for floating-rate payments tied to a specified benchmark, such as the London Interbank Offered Rate (LIBOR). In essence, they are swapping their interest rate risk with a counterparty, typically a financial institution or another party with a different interest rate exposure.

Interest rate swaps thus serve as mechanisms for risk transfer, allowing parties to mitigate the volatility associated with interest rate fluctuations. They enable borrowers to fix their interest expenses or lenders to convert floating-rate obligations into fixed-rate streams.

Key Features of Interest Rate Swaps

To grasp the intricacies of interest rate swaps, it is essential to understand their fundamental characteristics:

- Notional Principal: The underlying amount upon which interest payments are calculated, but not exchanged.

- Fixed Rate: The predetermined interest rate paid by one party, typically locked in for the duration of the swap.

- Floating Rate: The variable interest rate paid by the other party, linked to a benchmark rate.

- Maturity: The date at which the swap agreement expires, ranging from a few years to decades.

Types of Interest Rate Swaps

The swap market encompasses a diverse array of instruments, each tailored to specific needs:

- Plain Vanilla Swaps: The most basic type of swap, involving a simple exchange of fixed and floating rates.

- Basis Swaps: Swaps that exchange different floating-rate benchmarks, such as LIBOR and the Euro Interbank Offered Rate (EURIBOR).

- Cross-Currency Swaps: Swaps that exchange interest payments in different currencies, managing currency risk.

- Exotic Swaps: More complex swaps with non-standard features, such as options or embedded derivatives.

Factors Shaping Swap Markets

The dynamics of swap markets are influenced by a confluence of factors:

- Monetary Policy: Central bank decisions on interest rates directly impact the pricing of swaps.

- Economic Outlook: Expectations about future economic growth and inflation shape the demand for swaps.

- Credit Risk: The creditworthiness of counterparties affects the pricing and availability of swaps.

- Regulatory Landscape: Government regulations aimed at reducing systemic risk impact the swap market.

Advantages of Interest Rate Swaps

Interest rate swaps offer a myriad of benefits:

- Risk Management: Hedging interest rate risk, reducing exposure to market volatility.

- Cost Optimization: Access to favorable interest rates, optimizing funding costs.

- Portfolio Diversification: Adding swaps to a portfolio enhances diversification and risk-return profiles.

- Arbitrage Opportunities: Exploiting price discrepancies between different swap markets.

Risks Associated with Swaps

Despite their advantages, swaps also carry inherent risks:

- Credit Risk: The possibility of a counterparty defaulting on its payment obligations.

- Market Risk: Fluctuations in interest rates can result in losses for swap holders.

- Basis Risk: The risk that the underlying floating-rate benchmark deviates from expectations.

- Liquidity Risk: The potential difficulty in unwinding or adjusting swap positions in a timely manner.

Murray Rothbard's Perspective

Murray Rothbard, known for his staunch advocacy of free markets and limited government intervention, viewed interest rate swaps with a critical eye.

Rothbard argued that swaps, like other derivatives, introduce artificial complexity and increase the potential for financial instability. He maintained that swaps could exacerbate market volatility and create systemic risk, particularly in the event of a widespread market disruption.

Interest rate swaps have evolved into indispensable instruments in the financial markets, facilitating risk management and optimizing investment strategies. Understanding the intricate workings of swaps is critical for navigating their multifaceted nature and harnessing their benefits while mitigating associated risks.

Murray Rothbard's insights offer a valuable perspective on the implications of interest rate swaps, cautioning against their potential to undermine financial stability. His work serves as a reminder to approach these complex instruments with prudence and a thorough understanding of their risks and rewards.

By delving into the depths of "Understanding Interest Rate Swaps," readers gain an invaluable roadmap to navigating the complexities of these financial agreements and making informed decisions in the dynamic world of financial markets.

4.1 out of 5

| Language | : | English |

| File size | : | 5131 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Word Wise | : | Enabled |

| Print length | : | 320 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Yorifumi Yaguchi

Yorifumi Yaguchi Ernie Morton

Ernie Morton Ernest Thompson Seton

Ernest Thompson Seton Tricia Brown

Tricia Brown Roald Dahl

Roald Dahl Erik Molvar

Erik Molvar Marie Colvin

Marie Colvin Marina Abramovic

Marina Abramovic John G Hemry

John G Hemry Eric D Miller

Eric D Miller Eric Burns

Eric Burns Nobody You Ve Heard Of

Nobody You Ve Heard Of Erin Austen Abbott

Erin Austen Abbott Eric Nylund

Eric Nylund Eric S Raymond

Eric S Raymond Pat Manocchia

Pat Manocchia Steve Scott

Steve Scott Jo Bartlett

Jo Bartlett Janice P Nimura

Janice P Nimura Lawrence Schiller

Lawrence Schiller

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Terry PratchettUnveiling the Secrets of Your Ancestors: Connecting With Your Ancestors...

Terry PratchettUnveiling the Secrets of Your Ancestors: Connecting With Your Ancestors...

Ignacio HayesUnveiling the Divine Secrets of African Spirituality: Cooking For The Orishas

Ignacio HayesUnveiling the Divine Secrets of African Spirituality: Cooking For The Orishas Brett SimmonsFollow ·4k

Brett SimmonsFollow ·4k Floyd PowellFollow ·7.3k

Floyd PowellFollow ·7.3k Christian CarterFollow ·7.3k

Christian CarterFollow ·7.3k Mitch FosterFollow ·6.9k

Mitch FosterFollow ·6.9k Victor HugoFollow ·19.7k

Victor HugoFollow ·19.7k Clay PowellFollow ·7.1k

Clay PowellFollow ·7.1k Arthur MasonFollow ·2.4k

Arthur MasonFollow ·2.4k Ralph Waldo EmersonFollow ·6.5k

Ralph Waldo EmersonFollow ·6.5k

Roland Hayes

Roland HayesMagda: A Mother's Love, A Daughter's Redemption - A...

Immerse Yourself in the Captivating True Story...

Spencer Powell

Spencer PowellSnow White Retold: A Tale of Love, Magic, and...

Once upon a time, in...

Jake Powell

Jake PowellMaster the SATs with Effective Strategies from 99th...

The SATs are a challenging exam,...

Brian Bell

Brian BellSEO for Dummies: Unlock the Secrets to Search Engine...

In today's digital...

Jaylen Mitchell

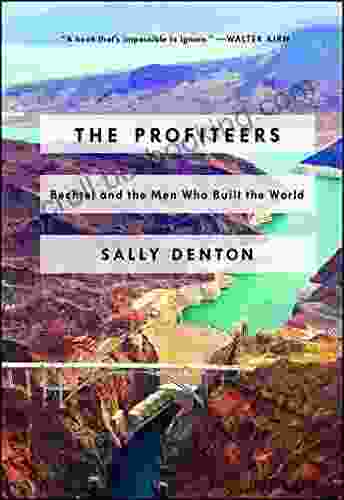

Jaylen MitchellBechtel: Unveiling the Unsung Heroes Who Built the World

In the annals of global infrastructure, the...

4.1 out of 5

| Language | : | English |

| File size | : | 5131 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Word Wise | : | Enabled |

| Print length | : | 320 pages |